Table of Content

The discount or premium should be reflected in the example for as long as it is in effect. The creditor may assume that a discount or premium that would have been in effect for any part of a year was in effect for the full year for purposes of reflecting it in the historical example. A value for the margin must be assumed in order to prepare the example.

State law requirements are inconsistent with the requirements contained in chapter 4 of the Act and the implementing provisions of this part and are preempted if the creditor cannot comply with state law without violating Federal law. The requirements of this paragraph do not apply to ARMs with terms of one year or less. The length of the remaining loan term expected on the date of the interest rate adjustment and any change in the term of the loan caused by the adjustment. Creditors may not make changes to, deletions from, or additions to the special information booklet other than the changes specified in paragraphs through of this section.

What are the warning signs of a dishonest lender?

An assignee holding or servicing a high-cost mortgage shall not, for the remainder of the one-year period following the date of origination of the credit, refinance any high-cost mortgage to the same consumer into another high-cost mortgage, unless the refinancing is in the consumer's interest. A creditor is prohibited from engaging in acts or practices to evade this provision, including a pattern or practice of arranging for the refinancing of its own loans by affiliated or unaffiliated creditors. For a transaction in which the interest rate may or will vary during the term of the loan or credit plan, other than a transaction described in paragraph of this section, the maximum interest rate that may be imposed during the term of the loan or credit plan.

Some plans may call for payment in full of any outstanding balance. Others may permit you to repay over a fixed time, for example 10 years. A statement that, except for changes to the interest rate and other changes permitted by law, the rates and terms of the loan may not be changed by the creditor during the period described in paragraph of this section.

Texas Laws Regarding Home Equity Loans for Borrowers

Notwithstanding paragraphs or of this section, nothing in this section prevents the creditor, at its option, from changing the rate or terms of the loan to accommodate a specific request by the consumer. For example, if the consumer requests a different repayment option, the creditor may, but need not, offer to provide the requested repayment option and make any other changes to the rate and terms. The maximum monthly payment based on the maximum rate of interest for the loan or, if a maximum rate cannot be determined, a rate of 25%. If a maximum cannot be determined, a statement that there is no maximum rate and that the monthly payment amount disclosed is an estimate and will be higher if the applicable interest rate increases. Application or solicitation disclosures. A creditor shall provide the disclosures required under paragraph of this section on or with a solicitation or an application for a private education loan.

Creditors using this alternative must include a statement that the consumer should inquire about the rate limitations that are currently available. Determination of the minimum periodic payment. This disclosure must reflect how the minimum periodic payment is determined, but need only describe the principal and interest components of the payment. Other charges that may be part of the payment may, but need not, be described under this provision. Date for obtaining disclosed terms.

FDIC Law, Regulations, Related Acts

The disclosures required by paragraph of this section shall be in the form of a table located within the table described in paragraph of this section. These disclosures shall appear in the same order as, and with headings and format substantially similar to, the table inside the larger table in forms H--4 and in appendix H to this part. The renewal of optional insurance purchased by the consumer and added to an existing transaction, if disclosures relating to the initial purchase were provided as required by this subpart. Actual charge.The amount imposed upon the consumer for any settlement service shall not exceed the amount actually received by the settlement service provider for that service, except as otherwise provided in paragraph of this section. For a transaction secured by a consumer's interest in a timeshare plan described in 11 U.S.C. 101, paragraph of this section does not apply.

If the replacement index is newly established and therefore does not have any rate history, it may be used if it and the replacement margin will produce a rate substantially similar to the rate in effect when the original index became unavailable. By contrast, the filing of a judgment against the consumer would permit termination and acceleration only if the amount of the judgment and collateral subject to the judgment is such that the creditor's security is adversely affected. If the consumer commits waste or otherwise destructively uses or fails to maintain the property such that the action adversely affects the security, the plan may be terminated and the balance accelerated. Illegal use of the property by the consumer would permit termination and acceleration if it subjects the property to seizure. If one of two consumers obligated on a plan dies the creditor may terminate the plan and accelerate the balance if the security is adversely affected.

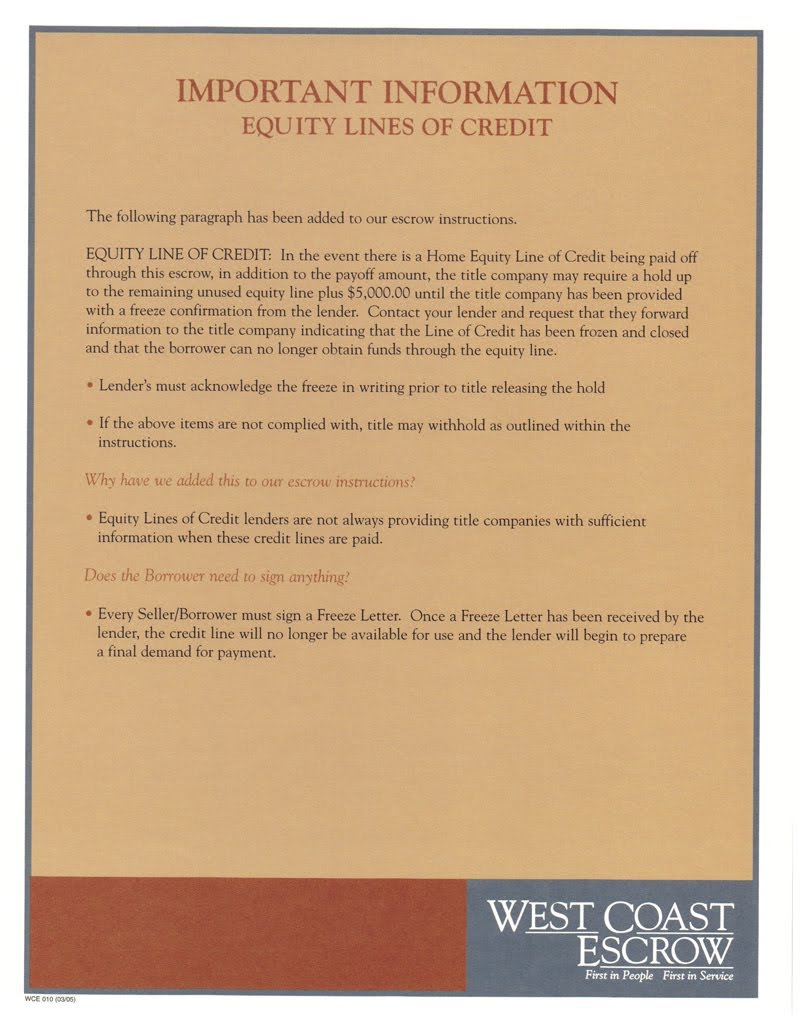

The lender may stop credit advances on your account during any period in which interest rates exceed the maximum rate stated in your agreement, depending on what your contract says. To cancel, you must inform the lender in writing within the three-day period. Then the lender must cancel its security interest in your home and must also return fees you paid to open the plan. Consider your options and your budget.

If instead you have ahigher-priced mortgagewith an APR higher than a benchmark rate called the average prime offer rate , you may have additional rights. You may be entitled to these rights if your higher-priced mortgage is used to buy a home, for a home equity loan, second mortgage, or a refinance secured by your principal residence. These additional protections do not apply to HELOCs. If you have a higher-priced mortgage, theCFPB has additional information about your rights.

A variable rate must be based on a publicly available index (such as the prime rate published in some major daily newspapers or a U.S. Treasury bill rate); the interest rate will change, mirroring fluctuations in the index. To figure the interest rate that you will pay, most lenders add a margin, such as 2 percentage points, to the index value. Because the cost of borrowing is tied directly to the index rate, it is important to find out what index and margin each lender uses, how often the index changes, and how high it has risen in the past. Reducing the loan amount based upon a certification or other information received from the covered educational institution, or from the consumer, indicating that the student's cost of attendance has decreased or the consumer's other financial aid hasincreased. A creditor may make corresponding changes to the rate and other terms only to the extent that the consumer would have received the terms if the consumer had applied for the reduced loan amount. Mortgage-related obligations mean property taxes; premiums and similar charges identified in § 1026.4, , , and that are required by the creditor; fees and special assessments imposed by a condominium, cooperative, or homeowners association; ground rent; and leasehold payments.

Self-certification information. A statement that, before the loan may be consummated, the consumer must complete the self-certification form and that the form may be obtained from the institution of higher education that the student attends. A description of any payment deferral options, or, if the consumer does not have the option to defer payments, that fact. Whether the applicable interest rates typically will be higher if the loan is not co-signed or guaranteed. Basis of disclosures and use of estimates.

To satisfy the disclosure requirements of paragraph of this section, the creditor shall provide the appropriate model form in Appendix H of this part or a substantially similar notice. If the disclosed finance charge is overstated, and the disclosed annual percentage rate is also overstated but it is closer to the actual annual percentage rate than the rate that would be considered accurate under paragraph of this section. New information specific to the consumer or transaction that the creditor did not rely on when providing the original disclosures required under paragraph of this section. Any rules relating to changes in the index, interest rate, payment amount, and outstanding loan balance including, for example, an explanation of interest rate or payment limitations, negative amortization, and interest rate carryover. When an obligation includes a finance charge other than the finance charge described in paragraph of this section, a statement indicating whether or not the consumer is entitled to a rebate of any finance charge if the obligation is prepaid in full or in part.

The date by which or the period within which any credit extended may be repaid without incurring a finance charge due to a periodic interest rate and any conditions on the availability of the grace period. If no grace period is provided, that fact must be disclosed. If the length of the grace period varies, the creditor may disclose the range of days, the minimum number of days, or the average number of the days in the grace period, if the disclosure is identified as a range, minimum, or average. In disclosing in the tabular format a grace period that applies to all features on the account, the phrase "How to Avoid Paying Interest" shall be used as the heading for the row describing the grace period. If a grace period is not offered on all features of the account, in disclosing this fact in the tabular format, the phrase "Paying Interest" shall be used as the heading for the row describing this fact.

For a variable-rate account, a creditor must disclose an annual percentage rate based on the applicable index or formula in accordance with the accuracy requirements set forth in paragraph of this section. Provision of information about credit counseling services. The finance charge is the cost of consumer credit as a dollar amount. It includes any charge payable directly or indirectly by the consumer and imposed directly or indirectly by the creditor as an incident to or a condition of the extension of credit.

In the case of certain administrative proceedings, the rescission period shall be extended in accordance with section 125 of the Act. If the disclosures required by paragraph of this section are not provided to the consumer in person, the consumer is considered to have received the disclosures three business days after they are delivered or placed in the mail. For interest-only or negatively amortizing payments, the amount of the current and new payment allocated to principal, interest, and taxes and insurance in escrow, as applicable. The current payment allocation disclosed shall be the payment allocation for the last payment prior to the date of the disclosure.